John’s business was struggling with debt.

John was an existing Lawrence client who sought advice as his business was asset rich but cash poor. This was a result of the downturn of the construction and mining industry, and it had impacted the cashflow in their business.

They had large debt against their commercial property and their bank was putting pressure on them in relation to breaching their reporting covenants.

John needed a fresh pair of eyes and expert advice to take the pressure off and help with the burden of debt.

| BUSINESS STAGE: | BUSINESS AGE: | INDUSTRY: | PROBLEM: |

| Established | 20+ | Mining & Construction | Cashflow |

How We Helped

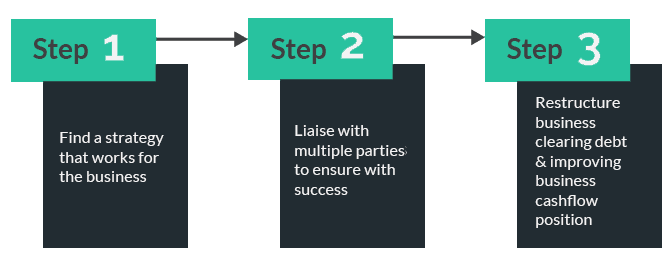

Lawrence Financial Advisors saw an opportunity to transfer John’s commercial property into his Self-Managed Super Fund (SMSF) and undertook a detailed feasibility study for this option.

This would enable the cash in John’s SMSF to be used to purchase the commercial property, clearing all business and personal debt. Additionally, this would create income tax savings with the rent on the property being taxed at the lower tax rate of 15% in the SMSF. Plus, we found a strategy that allowed us to transfer the property in for nominal ($20) stamp duty!

The major challenge was obtaining finance approval for the SMSF loan, due to the tenant for the property being the business, which was struggling financially.

After months of work restructuring and working with the Accountant (as well as dealing with Banks, Lawyers, Valuers and the Office of State Revenue), we settled the transaction and achieved the objectives of clearing all debt in John’s business.

The Outcome:

John’s business is debt free!

After working with Lawrence’s Business Advisors and SMSF specialists, John has saved tens of thousands in tax every year. His business is cashed up and debt free, he no longer has the stress of bank reporting covenants and has improved his business asset protection position.

John saved his business. How could we help you?

Ask how our Business Management Services can help you.